CBT Online Program: Virtual Care That Breaks Barriers and Builds Futures

November 6, 2025

Written and reviewed by the leadership team at Pathfinder Recovery, including licensed medical and clinical professionals with over 30 years of experience in addiction and mental health care.

Virtual treatment for addiction has become increasingly accessible across the New England region, with many insurance plans now covering telehealth services at the same rate as in-person visits. For individuals and families asking is online rehab covered by insurance, the answer is increasingly positive, though it depends heavily on your specific plan and location.

Leading national and regional insurers throughout Vermont, Massachusetts, Connecticut, and New Hampshire recognize the effectiveness of virtual treatment. They have expanded their coverage to include online therapy sessions, medication management, and group support programs. This shift has made quality care more accessible for individuals who may face transportation challenges, live in rural areas, or need flexible scheduling options that work with their daily responsibilities.

Many recovery providers maintain network partnerships with numerous leading health plans and work with individuals and their carriers to identify coverage options that fit within their budget. Provider staff typically handle insurance verification and can explain what services are covered under specific plans, helping remove financial barriers that might otherwise prevent someone from seeking help.

Coverage typically includes individual therapy sessions, group counseling, and psychiatric services for co-occurring mental health conditions alongside addiction treatment. The extent of coverage varies by plan, but many policies now offer comprehensive virtual treatment benefits that make recovery support both accessible and affordable for people throughout the region.

Tool: Parity Assessment Checklist

Telehealth parity laws require insurance plans to cover virtual care—like online SUD treatment—on equal footing with in-person treatment. Before these laws, insurers could pay less or even deny coverage for telehealth, making access unpredictable. Now, most states have rules stating that if a service is covered in-person, it must also be covered when delivered by telehealth, provided it’s clinically appropriate6. This shift means that when people ask, "is online rehab covered by insurance," the answer is increasingly yes, if the service would be covered in a clinic setting.

But parity doesn’t guarantee smooth sailing. States vary in how they define parity, and some plans still require extra steps like prior authorization for virtual care. Think of it like being allowed to enter a concert with your ticket—telehealth parity laws let you in, but you might still wait in a longer line than those attending in person.

Federal laws set the foundation for how insurance must treat virtual SUD treatment. The Mental Health Parity and Addiction Equity Act (MHPAEA), with new rules taking effect in January 2025, requires that insurance plans cover SUD treatment—including virtual options—no more restrictively than medical or surgical care. This means plans can’t impose higher costs or tighter limits just because treatment is online or focused on substance use3.

Medicare and Medicaid also play major roles. Medicare expanded its coverage to include intensive outpatient programs (IOPs) for SUD in 2024, but this only applies to in-person IOPs for now—not virtual ones—while Medicaid coverage is shaped by each state’s policies2, 3. New DEA rules extended telemedicine flexibilities for prescribing certain medications through December 2026, keeping virtual access open for many3.

Insurance coverage for virtual addiction treatment services varies significantly depending on your specific plan type. Most leading commercial carriers now recognize telehealth as an equivalent service delivery method, covering virtual therapy sessions, medication management, and group counseling at the same rates as in-person care.

| Insurance Type | Virtual Coverage Status | Typical Cost Structure |

|---|---|---|

| Commercial Plans | High (Parity Laws Apply) | Copays ($20-$50) or Coinsurance (20%) after deductible. |

| Medicaid (Expansion States) | High (Includes VT, MA, CT, NH) | Often $0 or nominal copays ($1-$5). |

| Medicare | Limited (No Virtual IOP) | Standard Part B coinsurance (20%) for covered services. |

For example, many plans cover telehealth appointments at 80% after the deductible is met, with typical copays ranging from $20 to $40 per session. This parity became standard following the 2020 CARES Act telehealth provisions and continues across most plans today.

Employer-sponsored health plans typically follow commercial insurance guidelines, offering robust virtual care benefits. However, coverage details can vary based on plan design and employer selections. Some plans may have different copayment structures or session limits for telehealth versus traditional appointments. Common structures include $25-50 copays for individual therapy sessions and $10-20 copays for group counseling, though high-deductible health plans may require meeting the deductible before coverage begins.

Medicare and Medicaid both play major roles in covering treatment for people seeking recovery, but their approach to virtual SUD care is quite different. Medicare made headlines in 2024 by expanding coverage for intensive outpatient programs (IOPs), yet this benefit is limited to in-person services. Virtual IOPs are still excluded, leaving a gap for those who need remote care—especially older adults or people with disabilities hoping to access support from home2, 3.

On the other hand, Medicaid is much more flexible, with 41 states having expanded their programs to cover a wide range of telehealth-based SUD services, including outpatient counseling, medication management, and co-occurring mental health treatment. In states that have not expanded Medicaid, individuals may find virtual SUD coverage hard to obtain, creating uneven access even within neighboring regions2, 8.

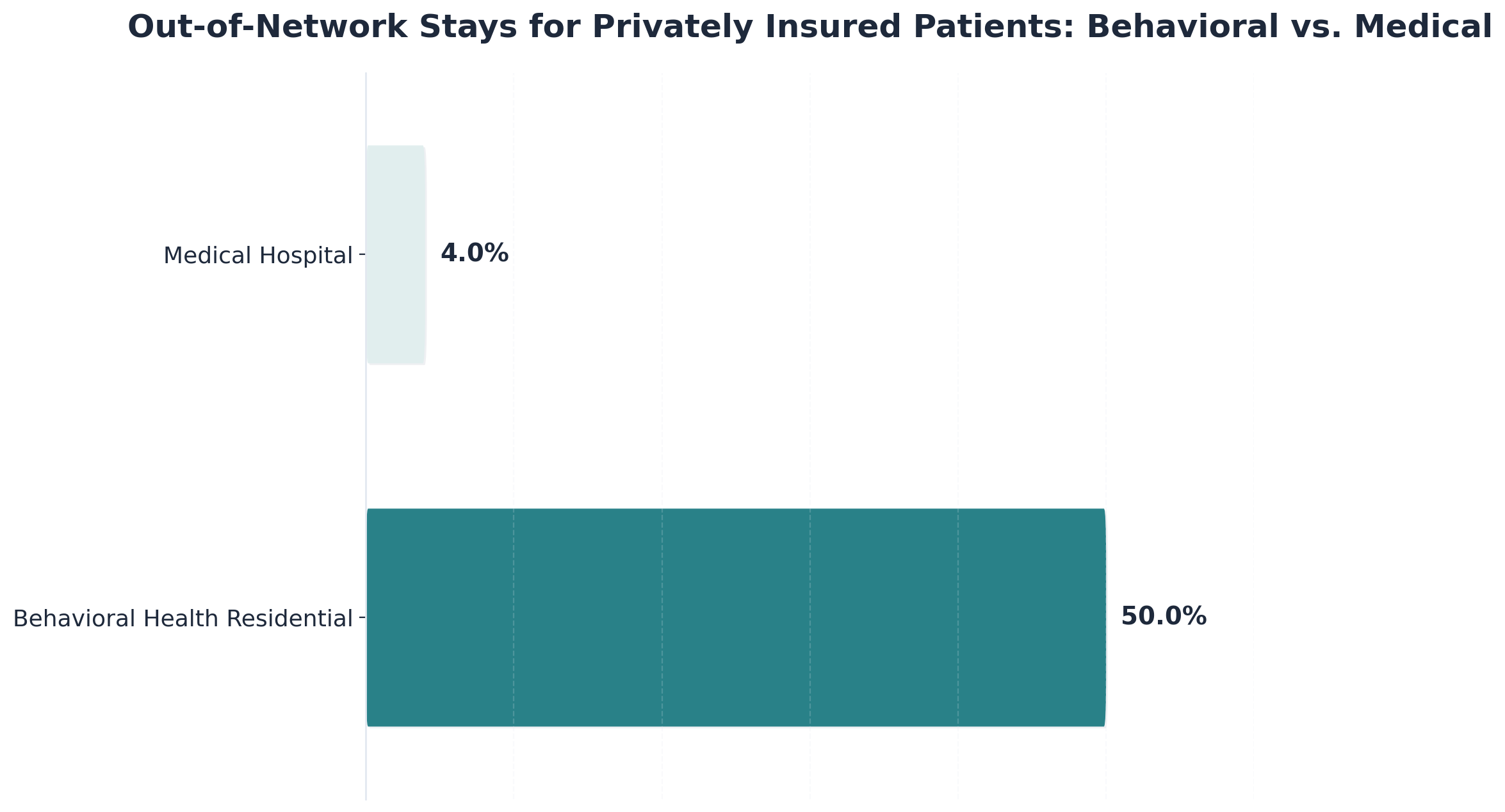

Commercial insurance plans frequently advertise comprehensive telehealth benefits, but the reality can be much more complicated. The big obstacle is network adequacy: even if a plan says virtual SUD treatment is covered, finding an in-network provider can be tough. In fact, more than half of behavioral health residential treatment stays for privately insured patients are out-of-network, compared to just 4% for medical hospital stays1.

This means that, while the answer to "is online rehab covered by insurance" is often yes on paper, many people still end up facing larger bills or denied claims simply because their chosen provider isn’t in-network. Imagine network adequacy like a map of train stops—some routes have plenty of stops (providers) to choose from, while others leave you stranded far from your destination. For virtual SUD care, the map can be especially sparse.

Once individuals understand their coverage type, the next step involves navigating the authorization and reimbursement processes—which can feel overwhelming, especially when seeking addiction treatment services. The good news is that many carriers recognize the medical necessity of virtual recovery services and provide coverage for telehealth appointments at the same rate as in-person visits.

Pathfinder Recovery maintains in-network relationships with numerous carriers serving Vermont, Massachusetts, Connecticut, and New Hampshire. These established partnerships mean pre-negotiated rates and streamlined billing processes, reducing out-of-pocket costs and administrative hassles for individuals seeking care.

"Authorization typically takes 2-5 business days, though urgent cases may receive expedited review. Clinical staff handles verification by confirming specific details such as diagnosis codes, treatment plan requirements, and medical necessity documentation."

Patients can facilitate a smoother authorization process by having certain information ready:

For those with out-of-network benefits or unique coverage situations, staff members work collaboratively to identify solutions that fit within available resources. They can provide superbills and detailed documentation for reimbursement claims and explore alternative payment structures when needed.

Prior authorization is like getting a permission slip before you start virtual SUD treatment. Insurance companies want proof that the care is medically necessary, so they require your provider to submit documents explaining your need for virtual support. This might include clinical assessments, treatment history, and sometimes a justification for why telehealth is the best fit.

Insurers then review these details against their own rules, which can differ from one plan to the next. Even though laws like the Mental Health Parity and Addiction Equity Act say SUD care shouldn’t have extra hurdles, studies show that insurers still use different criteria from standard clinical guidelines, slowing down or even blocking timely care5. The process can feel confusing, but knowing what paperwork is needed—and staying in touch with your provider—helps keep things on track.

When people ask "is online rehab covered by insurance," it’s only part of the story—most plans still leave patients responsible for some out-of-pocket expenses. These can include deductibles (the amount you pay before insurance kicks in), co-pays (a set fee per session), and coinsurance (a percentage of the total cost).

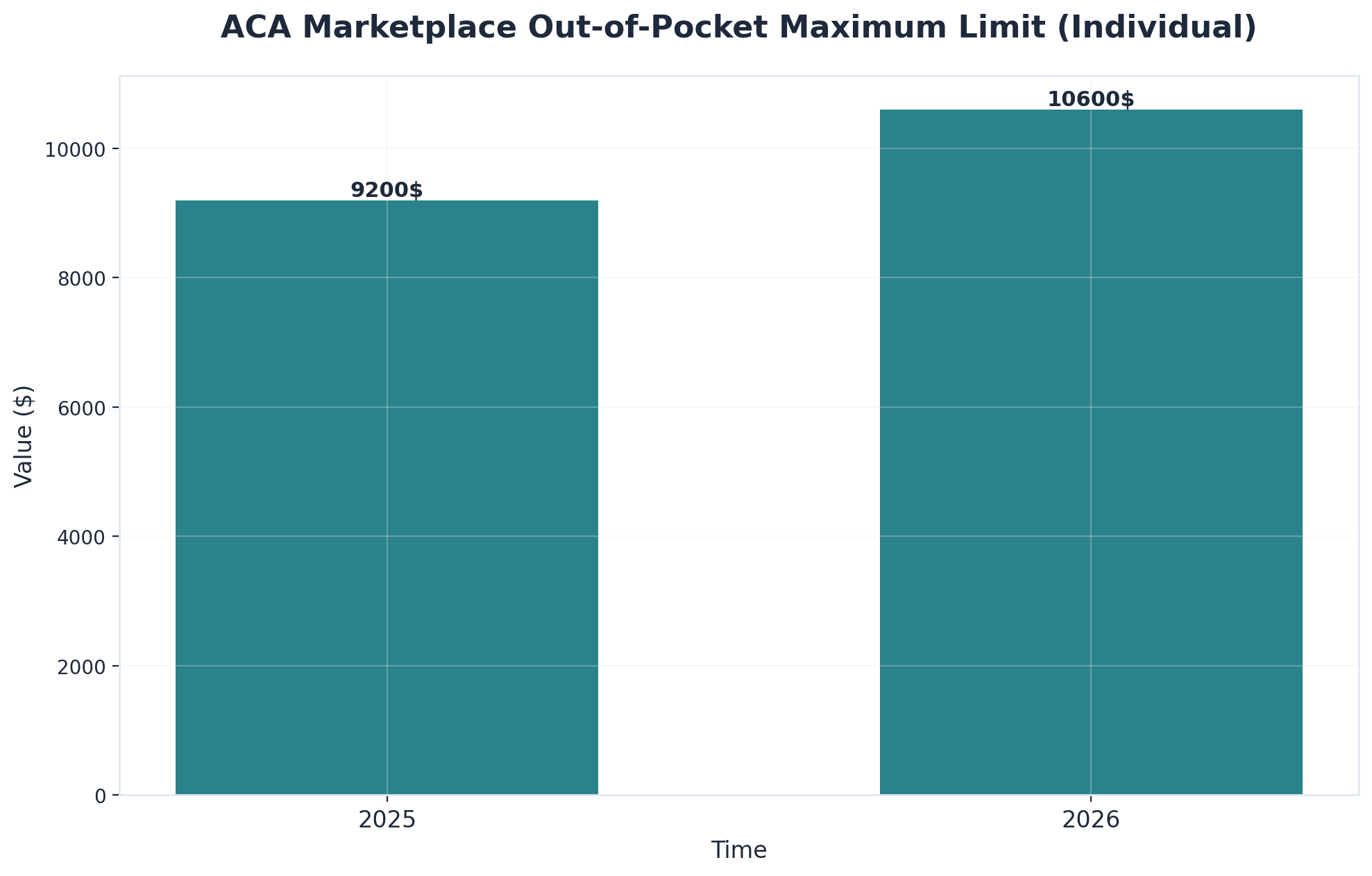

For 2026, the out-of-pocket maximum for individual ACA marketplace plans is set to increase to $10,600—a 15% jump from the previous year, showing how costs can add up even with coverage1. If a provider is out-of-network or a claim is denied, costs may be even higher, making it essential to check your plan details and ask about network status up front.

Understanding reimbursement processes is just the first step—the next is finding providers who accept insurance while delivering quality virtual care at accessible price points. Several factors contribute to making telehealth recovery services more affordable than traditional in-person treatment models.

When selecting a virtual recovery provider, patients should verify in-network status with their specific insurance plan, as this typically results in lower out-of-pocket costs than out-of-network services. Pathfinder Recovery is in-network with most insurances and will work with you or your provider to find care within your budget. We work with major carriers to serve patients across Vermont, Massachusetts, Connecticut, and New Hampshire. Administrative specialists can verify coverage, explain benefits, and identify options that fit within individual budgets.

For those with co-occurring disorders, integrated virtual treatment that addresses both dependency disorders and psychiatric concerns simultaneously often maximizes insurance benefits while delivering more effective outcomes than treating conditions separately. This comprehensive approach may qualify for enhanced reimbursement under mental health parity provisions.

Before signing up for online recovery care, it’s smart to double-check exactly what your insurance offers for virtual SUD treatment. Even though the answer to "is online rehab covered by insurance" is often yes, coverage specifics—like which services are included and which providers are in-network—can vary a lot depending on your plan and state. Research shows that administrative hurdles and unclear benefit details are top reasons people face delays or unexpected costs in behavioral health care1, 4.

A straightforward way to get clarity is to call your insurer’s member services line. Use this script to ensure you get the right answers:

The "Am I Covered?" Script:

Does my plan cover virtual SUD treatment and co-occurring mental health support?

Is Pathfinder Recovery in-network for my specific plan?

Are there any prior authorizations or referrals required before I start?

It’s like checking a hotel reservation before a big trip—you want all the details upfront so you’re not caught off guard. Document who you speak with and what they tell you, and request a summary of benefits in writing if possible. This helps protect you if billing questions come up later.

Selecting an in-network provider is like choosing a toll-free route for your recovery journey. When a provider is in-network, your insurance plan has a contract with them to offer services at pre-negotiated rates—cutting down your out-of-pocket costs and making billing more predictable. Research shows that over 50% of behavioral health residential treatment stays for privately insured patients are out-of-network, compared to just 4% for medical hospital stays, which means many people pay more than expected for care that could be covered1.

For virtual SUD treatment, using an in-network provider often means lower co-pays, less risk of surprise bills, and less time spent fighting claim denials. Always confirm with your insurer that a provider is truly in-network before scheduling an appointment.

Most major insurance providers now cover telehealth addiction treatment services. Coverage varies by plan and provider, so it's important to verify your specific benefits. Many treatment centers, including specialized practices in the Northeast region, maintain partnerships with leading insurers across Vermont, Massachusetts, Connecticut, and New Hampshire to help make care more accessible and affordable. Staff at these facilities typically coordinate directly with patients to identify options that fit within their budget and plan benefits.

Research consistently demonstrates that telehealth services for substance use disorders produce outcomes comparable to face-to-face care, with studies showing approximately 85% equivalent effectiveness rates. Virtual care offers the added benefits of increased accessibility, reduced transportation barriers, and greater scheduling flexibility, which can actually improve treatment adherence and long-term outcomes.

Yes, comprehensive virtual treatment programs can effectively address substance use disorders alongside concurrent psychiatric conditions such as depression, anxiety, or trauma-related disorders. These integrated services are delivered through secure, HIPAA-compliant digital platforms that protect patient privacy while providing coordinated care for complex behavioral health needs.

If your insurance denies coverage for virtual substance use disorder (SUD) treatment, you still have several steps you can take to appeal or seek other options. First, ask your insurer for a written explanation of the denial—this is usually called an "Explanation of Benefits" (EOB). Review the reason for denial: many times, it’s because of missing paperwork, a question about medical necessity, or the treatment being considered out-of-network. You and your provider can often submit additional documentation or a formal appeal, especially if you believe the care meets clinical guidelines for virtual SUD treatment. Research shows that insurance denials and administrative hurdles are a leading barrier to timely behavioral health care, but appeals can sometimes succeed if medical necessity is clearly documented1, 4.

If your appeal doesn’t work, ask about alternative covered services or in-network providers—sometimes a different virtual program or clinician can get approved. In states with strong telehealth parity laws, you may have extra rights to coverage if the same service would be covered in person6. Don’t hesitate to ask your provider or a local advocacy group for help navigating the process.

Yes, many insurance plans now cover medication-assisted treatment (MAT) like Suboxone (buprenorphine/naloxone) provided through online rehab, but the specifics can depend on your insurance type, state policies, and the provider's credentials. Thanks to extended federal telemedicine flexibilities, people in Vermont, Massachusetts, Connecticut, and New Hampshire can often access MAT virtually, as long as the prescriber meets regulatory requirements and the care is deemed medically necessary3. However, some insurance companies may require prior authorization or limit coverage to in-network providers, so it’s important to check your plan details first.

No, your employer will not automatically find out if you use your work insurance for virtual addiction treatment. Health information shared with your insurance company is protected under federal privacy laws like HIPAA, which means your employer cannot access your specific treatment details or diagnoses. When you use your employer-sponsored insurance, the only information your employer typically receives is related to overall plan usage—such as how many people used the insurance or the total costs for the group plan—not individual claims or types of care.

Pathfinder Recovery partners directly with your insurance plan to help keep your out-of-pocket costs as low as possible for virtual substance use disorder (SUD) treatment. The team guides individuals through every step—verifying benefits, confirming in-network status, and explaining what services are covered. By focusing on co-occurring mental health support alongside SUD care, Pathfinder ensures that the care provided matches what most major insurers require for coverage in Vermont, Massachusetts, Connecticut, and New Hampshire. Research shows that using in-network virtual providers and understanding your plan’s requirements are key to avoiding surprise bills and delays1.

Yes, there are important differences in insurance coverage between virtual intensive outpatient programs (IOPs) and traditional in-person IOPs. While the Mental Health Parity and Addiction Equity Act requires that benefits for substance use disorder (SUD) treatment—including IOPs—are not more restrictive than for other medical care, how this plays out depends on your insurance type and current policy updates. For example, Medicare’s 2024 expansion covers in-person IOPs for SUD, but specifically excludes virtual IOPs for now—meaning Medicare will not pay for virtual IOP in most cases, even though in-person is covered2, 3.

If you live in a state that hasn’t expanded Medicaid, getting insurance coverage for virtual substance use disorder (SUD) treatment can be especially challenging. In these 10 states, adults with low income often fall into a coverage gap—they earn too much to qualify for Medicaid but not enough to get help through ACA marketplace subsidies2, 8. While some community health centers or grant-funded clinics may offer sliding-scale or reduced-cost services, access to virtual SUD care through insurance is much more limited than in expansion states.

Insurance authorization for virtual substance use disorder (SUD) treatment typically takes anywhere from a few days to a couple of weeks, depending on your insurance plan and how quickly the required paperwork is submitted. Most insurers review prior authorization requests within 3 to 10 business days, but delays can happen if additional documentation is needed or if the insurer uses a different definition of "medical necessity" than your provider. Research shows that administrative hurdles, such as prior authorizations and insurer-specific criteria, are among the main reasons for treatment delays in behavioral health care4, 5.

Finding the right support for addiction and concurrent behavioral health challenges is a crucial step toward lasting recovery. Understanding your insurance coverage and what treatment options are available within your network can make this process more manageable and less overwhelming.

As covered throughout this guide, several key factors determine your coverage for co-occurring treatment: insurance parity laws ensure mental health and substance use services receive equal coverage to medical care, prior authorization requirements vary by plan and should be understood upfront, and in-network providers typically offer the most cost-effective options. Navigating these elements successfully requires knowing what questions to ask and where to find answers.

To move forward confidently, start by verifying your specific benefits through your insurance carrier's member portal or customer service line. Request details about authorization requirements, copayments, and which co-occurring treatment providers are in your network. Compare several in-network options—such as Pathfinder Recovery and other providers serving your region—to find the best clinical and financial fit for your situation. Don't hesitate to ask treatment centers directly about their experience working with your specific plan.

Armed with this knowledge about coverage requirements, cost considerations, and how to verify your benefits, you're now equipped to navigate the insurance landscape and access the care you need. Taking these informed steps removes financial uncertainty and allows you to focus on what truly matters—beginning your journey to lasting wellness and recovery.

November 6, 2025

November 6, 2025

November 6, 2025